Rating of the best deposits for pensioners for 2025

Special programs to increase and preserve money savings are offered to the older generation by most banking organizations. You can choose the best option by studying the rating of the best deposits for pensioners for 2025.

Content [Hide]

What are

Contributions, deposits (from the Latin word "depositum" - a thing deposited) - a sum of money given to a bank on certain conditions.

There are types of deposits according to the parameters:

- Purpose (natural or legal person).

- Currency.

- Timing.

- Interest rate.

- Functionality (replenishment, withdrawal).

Banks combine parameters into options for different purposes, functions: saving money from inflation, a long term deposit with a high rate, the ability to withdraw the required amount at any time.

There are special propositions for certain groups: students, pensioners, children.

purpose

There are two groups: individuals, legal entities.

An individual is an ordinary, real person with identity documents (birth certificate, passport, identity card). Deposits are opened after the execution of 14 years. An agreement is signed, where all the features are indicated: the name of the deposit, the initial amount, conditions. The rules of the contract must comply with the Civil Code of the Russian Federation, Chapter 44.

All deposits of individuals are insured. If the license was revoked from the bank, a moratorium on payments on deposits was introduced, the depositor will receive a refund within 2 weeks (initial amount with interest). The upper threshold is 1.4 million rubles. The amount up to 10 million rubles is paid under certain conditions (inheritance, alimony, escrow accounts received 3 months before the insured event).

Deposits of legal entities - monetary investments of companies, organizations.Such deposits are not insured by the insurance system. The return of funds is possible only for individual entrepreneurs (IP).

Currency

Distinguish ruble, currency deposits. Popular currencies: US dollars, euros. They have low inflation and low interest rates. There are multi-currency deposits - you can keep three currencies on one account at the same time, convert at a favorable rate.

Timing

Allocate urgent, on demand.

Urgent

Open for a specific time specified in the contract. The most common terms are: 1, 3, 6 months, 1 year.

According to the purpose, there are three subspecies of fixed-term investments: savings, settlement, accumulative.

- Savings - a classic type, has the highest interest rate. Money is stored on the account without replenishment, early withdrawal. Suitable for people with free funds, ready to postpone them for several months / years.

- Settlement - called universal, it can be consumable or consumable-replenished. The fixed amount can be replenished, a certain percentage can be withdrawn.

- Cumulative - like those people who want to save for a specific purpose (summer vacation, apartment, car). You can't withdraw, but you can top up. The larger the amount, the higher the interest charged.

Poste restante

Funds are kept in the account indefinitely. The client can withdraw part or all of the amount at any time. Due to the indefinite period, the rate is low 0.1% -0.01% per annum. Suitable for safe storage of funds, it is possible to withdraw any amount at the right time.

Interest rate

Rate, interest - payment for the use of the depositor's money. It can be fixed or floating. Can be charged on the balance after removal. All conditions are written in the contract.

Functionality

Banks independently compose the functionality of deposits. There are opportunities for replenishment, withdrawal of funds under certain conditions.

High interest is usually a long term without the possibility of withdrawal.

How to choose

Features when opening an account for pensioners are: a pension certificate or a PF certificate is enough, receiving a pension to a bank account.

There are main requirements for organizations, prescribed clauses of contracts that need to be reviewed in order to avoid mistakes:

- Select an organization with a valid license (check through the Central Bank website, hotline).

- Choose the appropriate conditions: high interest, selection of the duration of the action, the minimum amount.

- Additional functionality: withdrawal of certain amounts, depositing funds.

- Consider the conditions for early closure (on demand, value after the number of days).

- Learn the rules of registration (remotely online, in person at the department).

- Convenient location of the organization's offices.

- Possibility to order an online consultation.

- Additional bonuses, cashback from payment.

It is worth considering several suitable options, choosing transparent conditions, convenient Internet banking, and a simple mobile application.

Additional advice: ask friends, neighbors who use the services of different companies, compare reviews.

Rating of the best deposits for pensioners for 2025

The review of popular offers is based on the opinions of specialists, economists, bank employees. Three categories were selected according to the amount of annual payments: up to 5%, 5-6%, above 6%.

Up to 5%

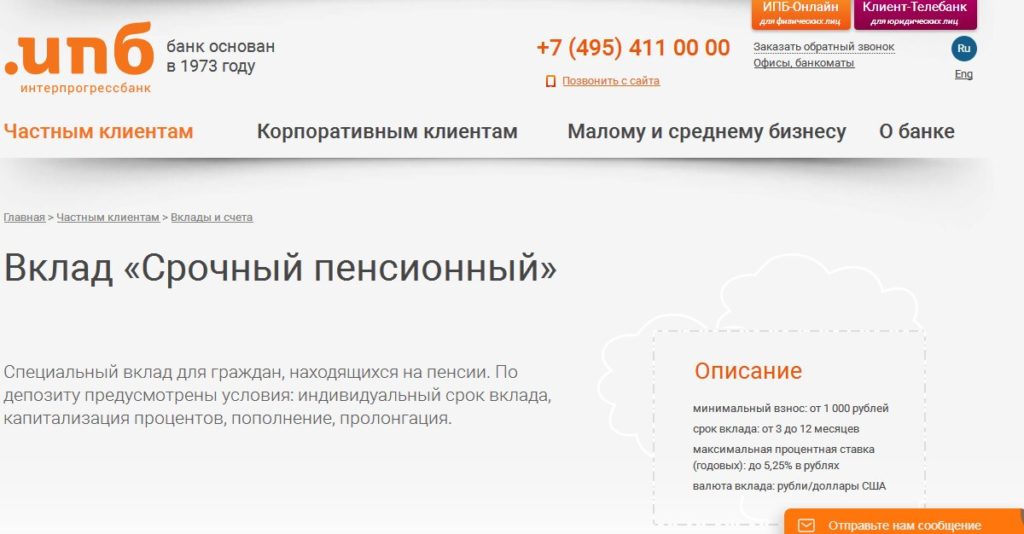

5th place "Term Pension" Interprogressbank

votes 0

The company is in the TOP 1-50 (best assets) - 1st place (2019).

Offers:

- percent 4.50 -5.25;

- terms (months): 3-12;

- the minimum contribution is 1,000 rubles;

- each month of accrual;

- can be supplemented (there are restrictions);

- automatic continuation.

Calculations depend on the terms (days \%): 91-180 - 4.5, 181-366 - 4.75, 367 - 5.25.

Restriction: you can not deposit funds a month before the end of the term.

Opening deposits - online (company website), offices, departments of the organization.

- choice of term, charges;

- can be added;

- a small starting fee;

- convenient site interface.

- no grace period;

- cannot be removed.

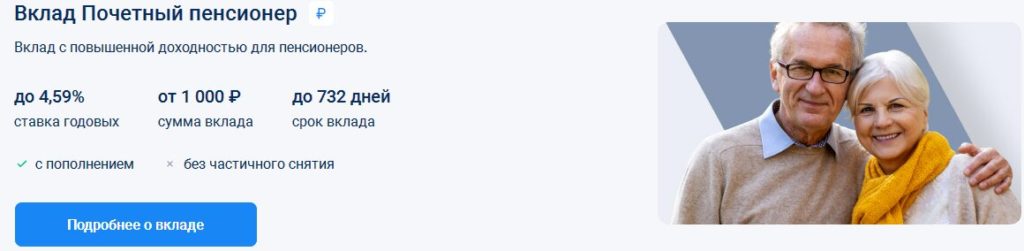

4th place "Honorary pensioner" of the bank "Uralsib"

votes 4

The organization is in the TOP 1-50 (best contributions): 10th place (2018), 9th place (2020).

Peculiarities:

- from 3.6% to 4.5%;

- term (days): 91, 181, 367, 732;

- contributions: 1.000-10 million rubles;

- payments every month;

- can be replenished.

Percentages depend on time (days \%): 91 - 3.6, 181 - 4.1, 367 - 4.5, 732 - 4.3.

Additional features: preferential termination, automatic continuation, online account opening.

- a small down payment;

- choice of term, charges;

- unlimited addition;

- monthly income;

- online consultation, discovery.

- cannot be removed.

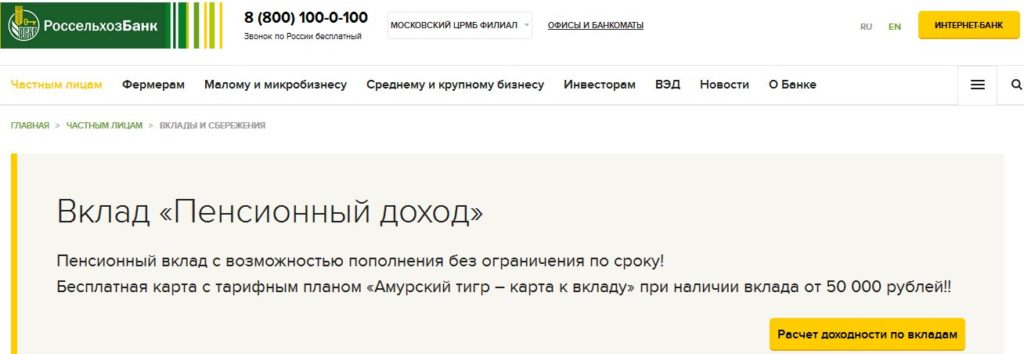

3rd place "Pension income" of the Russian Agricultural Bank

votes 14

Condition parameters:

- percent 4.3-4.5;

- terms (days): 395, 540, 730;

- contributions (rubles): minimum - 500, maximum - 2.000.000;

- payments every month;

- there are replenishments.

The site has an automatic online profitability calculator.

The second option for pensioners is "Pension Plus". Terms (days): 395, 730, 1095. Interest: 4, 4.3, 4.5. Contributions (rubles): 500 - 10.000.000. Additionally: capitalization every month. can be removed. replenish.

The choice is online consultations, a free phone number, a voice assistant.

- the minimum contribution is 500 rubles;

- choice of term, percentage;

- monthly payments;

- online communication, free phone numbers.

- expenditure transactions are not carried out.

2nd place "Just save up" with the bank "AK Bars"

votes 0

"AK Bars" - takes 3rd, 10th place in the TOP-50 (in terms of assets, increased rates for pensioners).

Peculiarities:

- up to 4.9%;

- from 10,000 to 5 million rubles;

- term: 3 months - 2 years;

- interest every month;

- can be replenished.

Interest depends on the term (months): 3 - 4%, 6 - 4.3%; 12 - 4.5%; 24 - 4.7%. Increase under conditions: +0.15% (opening an online deposit), +0.20% (providing a pension certificate).

The site has the ability to calculate profits, open an account online.

- choice of term;

- a small initial amount of funds;

- convenient online service site;

- additional increase.

- no partial withdrawal.

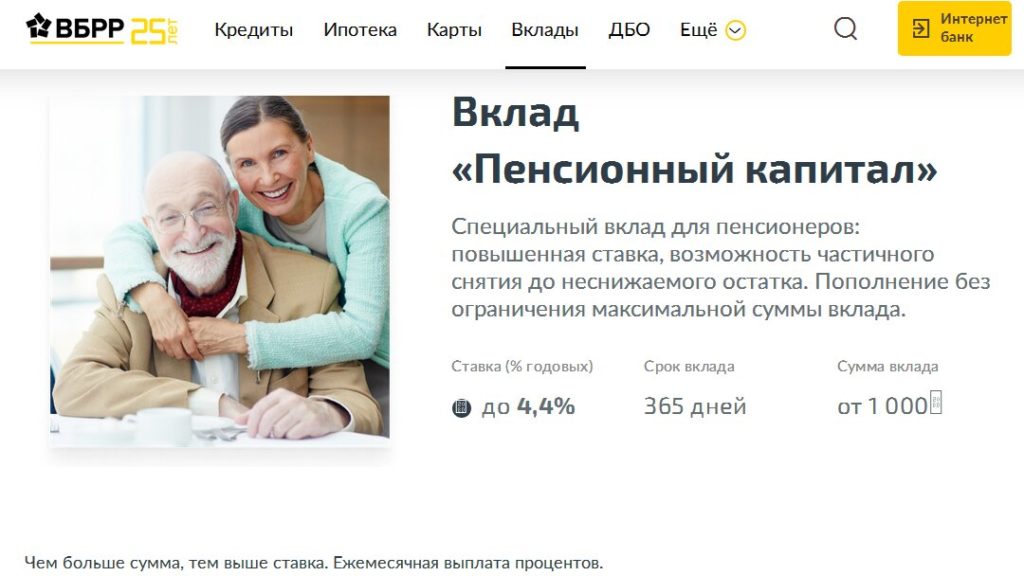

1st place "Pension Capital" of the All-Russian Bank for the Development of Regions

votes 7

The bank is in the TOP-10 (8th place in terms of assets).

Offers conditions:

- up to 4.4%;

- initial amount - 1,000 rubles;

- term 365 days;

- unlimited replenishment;

- partial withdrawal (up to a certain value);

- payment monthly.

Interest depends on the amount (rub.): 4% -1.000-30.000; 4.1% - 30.001-100.000; 4.2% - above 100,000.

You can choose, open a deposit on the website online, in the office. On the main page there is a free telephone number for consultations, addresses of branches. You can calculate the profit with an online calculator (the amount of money is entered).

- low initial amount;

- monthly payments;

- replenishment;

- can be removed;

- online consultations.

- not identified.

Rate 5%-6%

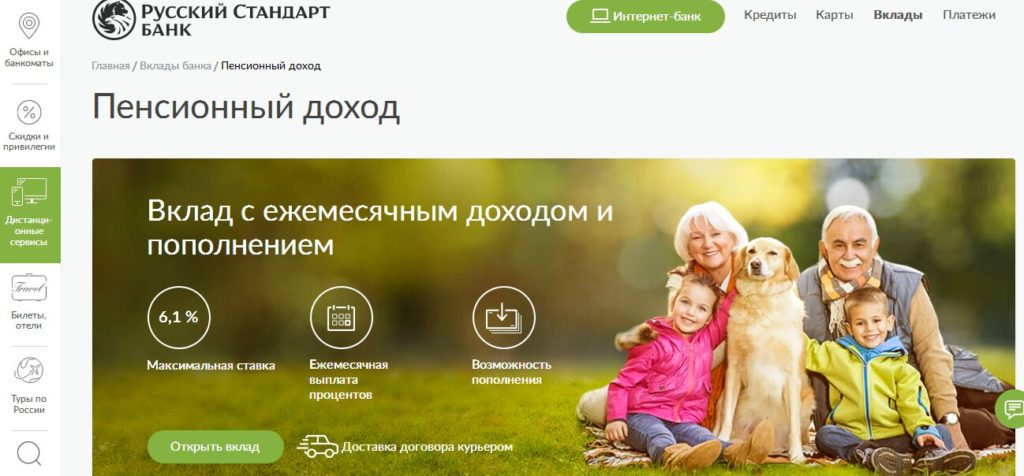

4th place "Pension income" of Russian Standard Bank

votes 0

Features of the agreement:

- income 5 - 6.1%;

- the first payment is 10,000 rubles;

- time 181-720 days;

- can be supplemented (within 90 days);

- 1 auto-renewal;

- remote execution - delivery of the contract by courier.

The increase in payments depends on time (day \%): 181 - 5, 360 - 5.75, 390 - 5.9, 540 - 6, 720 - 6.1.

Site page - income calculation table, instructions for online registration, advantages of the selected contract.

- increase in payments over time;

- simple execution of the contract;

- delivery of documents by courier;

- extra income every month.

- cannot be removed;

- no preferential conditions for early closing.

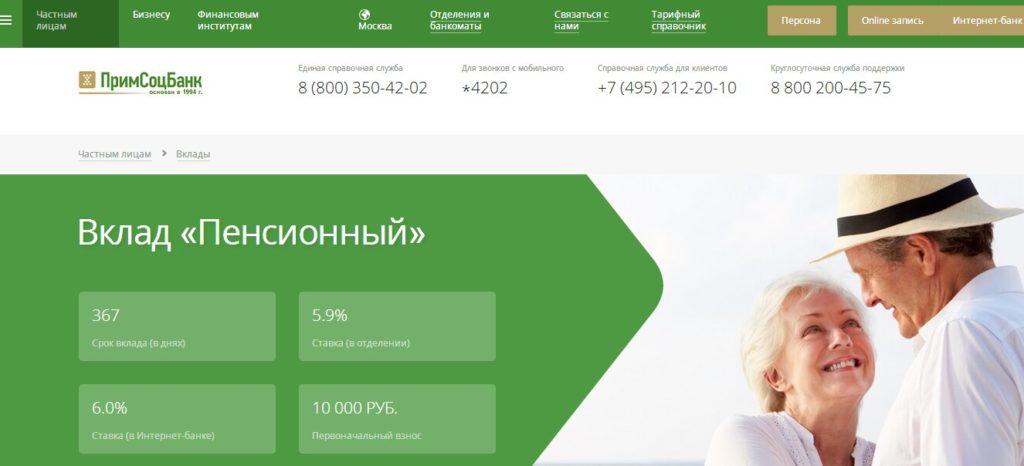

3rd place "Pension Online" Primsotsbank

votes 0

Offers:

- rates 5.9 (office), 6 (Internet bank);

- the first installment is 10,000 rubles;

- time 367 days;

- quarterly earnings;

- capitalization of your choice.

Adding - no restrictions, automatic continuation, no special rules for early closing.

Organization website - advantages of online opening, calculator, detailed conditions.

- income is higher when registering online banking;

- capitalization of choice;

- unlimited addition;

- quarterly earnings.

- without removal;

- no benefits for early closing.

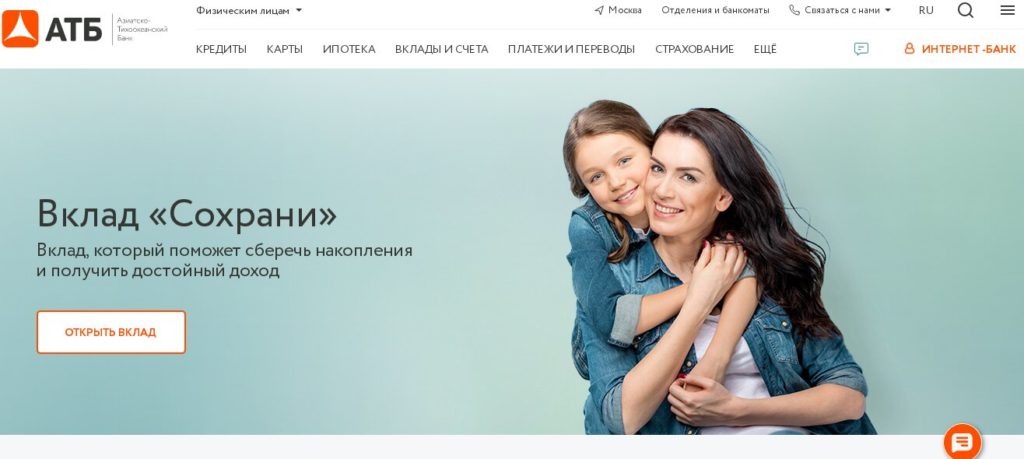

2nd place Deposit "Save" of the Asia-Pacific Bank

votes 0

The Asian-Pacific Bank company ranks 6th in the TOP by assets (2019, 2020).

Offer features:

- rate 4.6 - 5.5%;

- time 92 - 1098 days;

- min. contribution of 5,000 rubles;

- early closing - special rules;

- automatic renewal.

The change in interest payments depends on the time (day\%): 92 - 4.6, 182 - 5.1, 367 - 5.4, 731-1098 - 5.5.

Early closing rules: 0.5 stake if 70% of the contract time has passed.

The organization's website - online profit calculation, conditions for registration in the mobile version, Internet banking.

- min. investments - 5,000 rubles;

- choice of rates, time;

- preferential early closing rules;

- online design.

- cannot be withdrawn, replenished;

- payment of accruals at the end of time.

1st place "Pension" Absolut Bank

votes 2

The company "Absolut Bank" took the 9th place in the ratings (increased rate, 2019), 12th place (assets, 2020).

Sentence:

- rate 5.10-5.20%;

- min. contribution of 10,000 rubles;

- term 91-730 days;

- payments every month;

- replenish from 1.000 rub.

The rate varies (day \%): 91-271 - 5.1, 272-367 - 5.2, 368-541 - 5, 542-730 - 5.15.

On the site - an online calculator (calculates income from the amount, term). You can leave a request, consult with an employee of the department. Registration - the nearest office of the company.

- choice of terms;

- early closing benefits;

- promotional gifts to choose from;

- reusable replenishment;

- automatic continuations;

- the maximum contribution is unlimited.

- only one withdrawal.

Above 6%

4th place "Pension" of the Ural Bank for Reconstruction and Development (UBRD)

votes 2

Contract proposals:

- annual 6.45%;

- time 1100 days;

- min. the amount is 50,000 rubles;

- depositing funds (two ways);

- payments are credited to the account;

- preferential conditions for early closure.

Funds are deposited through branches (from 20,000 rubles), ATMs or Internet banking (unlimited).

Preferential conditions for early closing: 5.75% after 391 days.

Internet pages show conditions, benefits, callback ordering function.

- high annual;

- one term;

- preferential closing conditions;

- You can deposit different amounts.

- opening an account only in branches;

- high down payment.

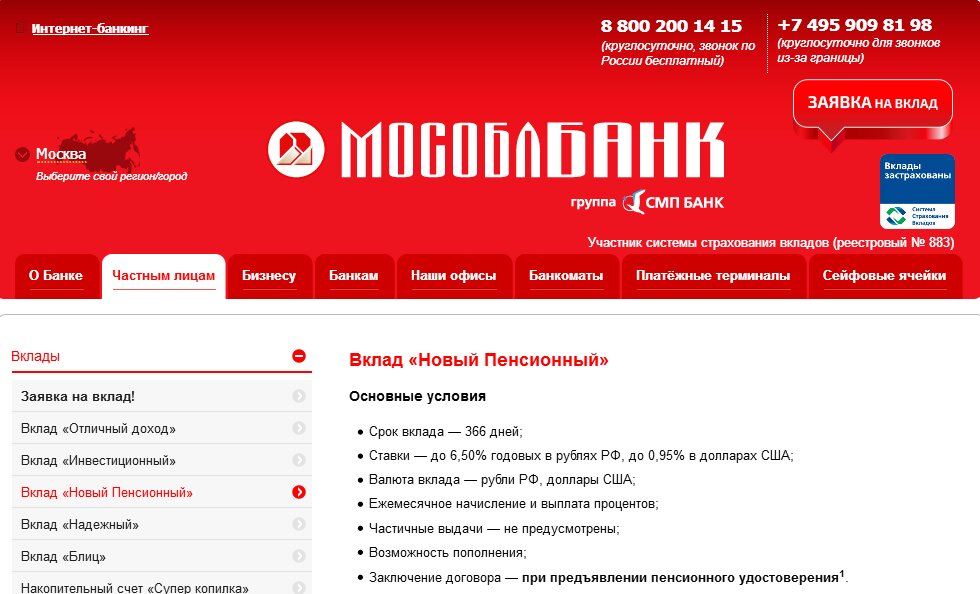

3rd place "New Pension" Mosoblbank

votes 0

Organization Mosoblbank is in the TOP 1-50: 2nd place (2019), 6th place (assets, 2020).

Offers:

- two types of investments: rubles, US dollars;

- amounts: 10.000-50 million rubles, 300-1 million US dollars;

- term - 366 days;

- accruals: rubles - 6-6.5%, US dollars - 0.75-0.95%;

- monthly payment;

- special conditions for early closure.

The company's website contains conditions, a calculator (you need to enter the currency, amount, term).

There are two tables: deposit rates, conditions for early closure. You can leave a request for a consultation - leave the data (name, phone number).

Detailed conditions about the features are presented in PDF format.

Two phone numbers are provided for round-the-clock communication within the territory of Russia, from abroad.

- two types of currency;

- you can pay extra;

- easy communication with a consultant;

- early closing conditions.

- cannot be removed.

2nd place "Grand +" MKB

votes 0

According to the financial rating (as of June 1, 2021), Credit Bank of Moscow (MCB) ranks 7th (assets), 11th (net profit).

Terms:

- rate up to 6.5%;

- contributions of 1.000-10 million rubles;

- terms 370-730 days;

- monthly payments;

- you can deposit funds for the first 3 months;

- There are 2 automatic renewals.

Additionally - getting a Wisdom card. Advantages: up to 4.5% on the balance, participation in the MKB Bonus program, cash withdrawals for free, up to 25% cashback from partners.

- high rate;

- choice of term;

- two auto-renewals;

- free Wisdom card;

- additional bonuses, cashback.

- cannot be removed.

1st place "Pension +" Post Bank

votes 12

The Post Bank company ranks 25th in Russia (assets, as of 06/01/2021).

Offers:

- annual 4.5% -6.5%;

- term 275 days;

- the first installment is 50,000 rubles;

- can be supplemented.

The main value is supplemented: 0.25% (payment by a Post Bank card for more than 10,000 rubles), 1.75% (receiving a pension on a card).

The site has an online application form: you need to enter a phone number, email address, full name.There is an income calculator: you enter the amount, the term, the basic conditions are selected.

Opening deposits in 2 ways: branches of the organization, Post Bank Online.

Advantages:

- high payouts;

- can be added;

- short term;

- additional income under conditions.

Flaws:

- high minimum deposit.

Conclusion

Preservation, accumulation of money is important for young people, the older generation. By studying the rating of the best deposits for pensioners for 2025, you can choose a good option for savings, additional monthly income.

new entries

Categories

Useful

Popular Articles

-

Top ranking of the best and cheapest scooters up to 50cc in 2025

Views: 131648 -

Rating of the best soundproofing materials for an apartment in 2025

Views: 127687 -

Rating of cheap analogues of expensive medicines for flu and colds for 2025

Views: 124515 -

The best men's sneakers in 2025

Views: 124029 -

The Best Complex Vitamins in 2025

Views: 121936 -

Top ranking of the best smartwatches 2025 - price-quality ratio

Views: 114978 -

The best paint for gray hair - top rating 2025

Views: 113393 -

Ranking of the best wood paints for interior work in 2025

Views: 110316 -

Rating of the best spinning reels in 2025

Views: 105326 -

Ranking of the best sex dolls for men for 2025

Views: 104362 -

Ranking of the best action cameras from China in 2025

Views: 102214 -

The most effective calcium preparations for adults and children in 2025

Views: 102009