Ranking of the best credit cards with a grace period for 2022

Most modern credit products using bank cards today in the Russian Federation provide for a special grace period (also known as a grace period, from the English “grace” - “delay”). This is the name of the time period during which the consumer is not charged interest and no commission is charged for the use of the money provided. This condition serves to ensure that the client uses the received card with a minimum of risks. Today, this interval can be from 50 to 200 days.

Content

General information about the grace period

Almost every bank, when applying for a credit card, offers a new user special conditions under which he can return the funds received, while paying interest on their use. This allows you to make purchases more profitably, but you still have to pay off the body of the loan itself without fail. As a rule, the considered financial relief only applies to non-cash transactions, which is why it is extremely unprofitable to withdraw cash from most credit cards, because such manipulation is subject to a hefty commission. The grace period is perfect only for the user who is able to repay the loans received from the bank on time and stably, while avoiding the accrual of late fees.

Grace and settlement periods - differences

Traditionally, once a month, the creditor bank sends an extract to the credited person with information about the current debt. The payment benchmark here is calculated according to the principle “for the month following the reporting month”. Thus, the client must pay off the current debt, which was formed a month before the present (the moment the statement was received) - this is called the billing period.The grace period is the period in which the user must pay off the current debt and so that the bank does not charge fines and interest on this amount (it is usually very individual for each financial and credit institution). As a result, the use of "grace" involves the return of borrowed funds strictly on the date specified in the signed documents with the credit institution.

IMPORTANT! Some lenders may even accrue interest during the grace period, but they are significantly small compared to the standard rate. Currently, in order to expand the scope of the services in question, more and more creditor banks are abandoning this practice altogether (i.e. grace time is absolutely free).

Grace period calculation options

Today, there are three classic options for which a financial institution sets an interest-free return period for funds issued.

- "Moment of the first financial transaction".

This method is considered the simplest and most comfortable for the client. The lender sets him a certain number of calendar days after the first write-off of funds, when you can continue spending without interest. In order to avoid overpayments, the accumulated debt must always be paid off before the end of the stipulated period. For example, “grace” is 55 days, the first write-off took place on June 1, which means that the entire accumulated amount must be paid off by July 26.

- "Dependence on generated reporting".

The meaning of this calculation is that the grace, in fact, is divided into two periods, as a rule, these are 30 and 20 days. During the first 30 days, you can spend borrowed funds, and after 30 days expire, the user will have 20 days to pay off all the debt accumulated during the first period without interest.If the terms are violated by the consumer, then fines are charged to him. At the same time, it should be noted that the due date of the report comes immediately after the end of the previous one and does not depend on the moment of repayment of the debt.

- "Calculation with respect to one-time transactions".

With this method, the client must return the money spent in the same order in which they were used. That is, it is required to constantly return exactly as much (and after a given time period established by the contract) as much money was spent for the last time. This method is tedious and requires a good memory of the consumer, and the risk of missing a payment and being late is extremely high.

Transactions not covered by the grace period

Each financial institution determines its own grace period program. Classically, it applies to non-cash payments and purchases through credit cards.

In the vast majority of cases, the grace period does not apply to cash withdrawals and money transfers (even to cards of holders of the same bank). If you withdraw cash, the borrowing bank will not only immediately take a commission, but will immediately begin accruing interest at an increased rate, and under certain conditions, the grace period may even end instantly. It is always worth remembering that the repayment of debts arising from non-cash purchases / payments occurs first, and only then cash withdrawals and other atypical transactions (for example, transfers) are taken into account.If an atypical transaction was made, then it is better to immediately pay off the entire amount of current liabilities and not think that having paid interest for, for example, cash withdrawals, they will go to pay interest on this particular operation - no, they will be credited as interest on a typical operation performed earlier (for example, a cashless purchase).

IMPORTANT! Experienced professionals believe that a credit card, even with a grace period, is not a panacea for situations where a large amount of cash is needed. The future overpayment for such an atypical operation will be simply incomparable. In such cases, it is much easier to take a cash loan from the bank immediately.

However, relatively recently, some banks began to provide grace in relation to cash withdrawals. Nevertheless, the conditions they offer regarding such operations leave much to be desired:

- An extremely small time period of such relief;

- A small amount is provided;

- Various bonuses and cashbacks for typical transactions are not available as a class in the main credit program.

Minimum payment

Regardless of which method of determining the grace period was chosen, there will always come a time when it will be necessary to make a minimum payment in order not to fall under penalties. In Russia, it ranges from 5% to 8% of the amount of funds used. If the minimum payment is not received by the bank at the time specified by the agreement, then the latter will decide that the client does not fulfill the conditions of the grace period and will charge not only interest on the debt, but also a fine, and may also cancel its effect altogether.However, cancellation is an extreme punitive option and usually a credit institution resorts to a temporary freeze and subsequent renewal of the financial relief period after the complete liquidation of the client's current financial obligations.

IMPORTANT! The idea of opening several credit cards at once from several financial and credit institutions with a grace period, in order to “transfer” funds from one card to another, when the time comes to get an endless and interest-free loan period, will not work. Firstly, there will always be an amount charged for service for all cards, secondly, no one will ever cancel the minimum payments for anyone, and thirdly, for each card someday you will have to return the full amount of the debt.

Advantages and disadvantages of credit cards with a grace period

Their undoubted advantages include:

- Particularly favorable conditions for making non-cash payments;

- The banking sector attaches good bonuses and promotions to such programs;

- For some time, money can be used completely free of charge - the main thing is to return it on time;

- Constant and conscientious use of the card increases the chances of approval of a larger loan, and not even necessarily in the institution that issued the credit card;

- The ability to use funds at any time of the day and within the available limit;

- After closing the main debt obligations on the card, borrowed funds may become available again.

Among the shortcomings, the following can be noted:

- Late repayment of borrowed funds entails the accrual of very high interest and penalties that are not close to standard rates;

- This type of lending without subsequent damage is available only to those persons who definitely have the opportunity to close their financial obligations on time during the grace period;

- Too much commission when withdrawing cash.

Useful tips for using grace period cards

- Selection of the desired limit based on the reality of income.

Experts recommend using the following calculation example: if the salary is 50,000 rubles per month, then it is better to choose a grace period for a period of no more than 150 days, with a total loan limit of 150,000 rubles. So it is quite possible to live the whole block without problems. However, it is advisable not to spend more money than you can cover at a time. Such a credit card should remain a tool of competent financial management and an emergency “cash cushion”, and not a “magic wand”, through which you can buy things that you will not have enough of your own money later.

- The obligation to carefully read the text of the contract.

It always spells out all the essential conditions, which include the interest rate. Now banks almost do not try to pull off the “fine print” trick, but it is advisable to take its draft (draft, sample) with you before signing the contract in order to read it more carefully. This is especially true for credit cards that are delivered to your home. The contract is usually not attached to them at all, and the client only signs the application, at the same time agreeing to the standard lending conditions, which the bank simply places on its website. Accordingly, before receiving a card and signing such an application, you need to fully familiarize yourself with the terms of the loan.

- Not using a credit card to withdraw cash.

The commission for this atypical operation for the grace period is usually very high.From this it is clear that cash withdrawals are best allowed in truly emergency situations.

- Using the card as collateral.

An excellent solution would be to transfer a credit card with a grace period when making a reservation at a hotel or when renting a car. Money from the card for such a service abroad (until the end of its provision) will not be debited, and by that time you can already pay from your own debit funds.

- Third-party refinancing is not a panacea.

If the user fails to pay off the delay on time, then you should not run to another bank and issue another credit card to pay for the previous one. It is easier to contact the original financial institution and go through the refinancing process there. In most cases, the dialogue on such topics turns out to be constructive, because the institution is in any case interested in the return of its funds, even if with some delay.

Difficulties of choice

First of all, it is necessary to specify the purpose of obtaining a card of the type in question. Most often it is used:

- As an emergency wallet for emergency large expenses - this option is really convenient, however, it is always worth remembering that these large expenses must be compensated to the creditor on time;

- As a wallet for cashless payments, this is where you can get the most benefit from grace cards, since most modern banks offer very attractive cashbacks and bonuses for such purchases (the number of trading partners for such programs can be in the hundreds).

Further, through such programs it is already possible to pay utility bills and make transfers at a certain discount, but you should not expect full benefits from such operations (in comparison with standard debit cards).

It must be borne in mind that the monthly mandatory payment can be calculated strictly individually. Accordingly, missing the deadline will mean the suspension of benefits.

Ranking of the best credit cards with a grace period for 2022

120 to 200 days grace period

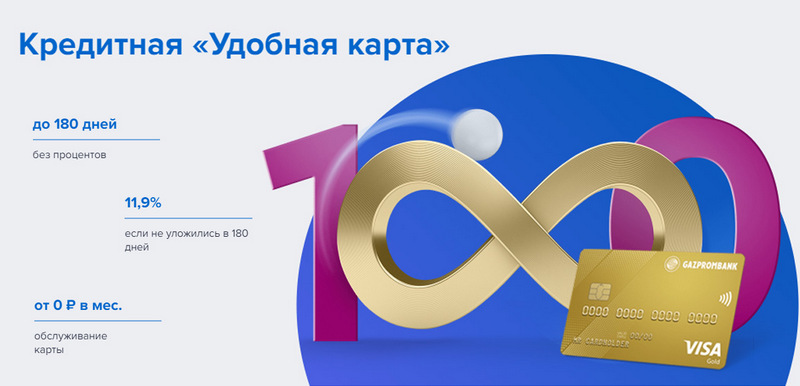

3rd place: Gazprombank - Convenient

Gazprombank offers a credit card with a long grace period and simple conditions for free service. A convenient card is issued in one visit to the bank with a passport, but does not offer any special bonuses.

| Grace period | up to 180 days, for non-cash payment |

| Limit size | up to 600,000 rubles |

| Interest rate | from 11.9% per annum |

| Purchase bonuses | No |

| Issue cost | is free |

| Maintenance cost | free of charge with the amount of spending from 5,000 rubles, otherwise - 199 rubles per month |

| Registration method | Online with delivery to your hands or to a bank branch |

| Terms of registration | 3-5 days |

- Free SMS notifications;

- Cash withdrawal at any ATM without commission;

- Simple terms of free service.

- There are no bonuses for purchases;

- High penalties for non-compliance.

2nd place: Citibank - "Prosto"

This financial institution is owned by Citigroup, one of the largest financial institutions in the world. It offers the population deposits, loans and bank cards, conducts operations with currency and securities. "Just a credit card" offers a long grace period, which also applies to cash withdrawals. In addition, its service is completely free.

| Grace period | up to 120 days |

| Limit size | up to 3,000,000 rubles |

| Interest rate | from 7% per annum |

| Purchase bonuses | discounts up to 20% at bank partners |

| Issue cost | is free |

| Maintenance cost | is free |

| Registration method | Online with delivery to your hands or to a bank branch |

| Terms of registration | 3-5 days |

- Free card service;

- Cash withdrawal at any ATM without commission;

- Lots of referral bonus programs.

- Only for residents of certain cities.

1st place: Avangard Bank - Classic

All standard Avangard credit cards of any system and status have an interest-free period for new customers of 200 days. Other conditions (limit, rates, other options) are set by agreement with the client.

| Grace period | up to 200 days, for non-cash payment, only for new customers |

| Limit size | up to 150,000 rubles |

| Interest rate | from 15% per annum |

| Purchase bonuses | discounts up to 30% at bank partners |

| Issue cost | is free |

| Maintenance cost | free of charge with an average monthly turnover of 7,000 rubles or more, otherwise - 600 rubles per year |

| Registration method | at a bank branch with an online application |

| Terms of registration | 3 – 5 days |

- Conditions are selected individually;

- Several design options to choose from;

- Simple terms of free service.

- Large grace period - only for new customers.

Up to 120 days grace period

3rd place: "ATB" - "Universal"

This is the key PKU of the Far East. It actively cooperates with Chinese and Japanese companies. His "Universal" program is one of the few that has an interest-free period for cash withdrawals. It also offers a large cashback in various categories.

| Grace period | up to 120 days, for non-cash payment and cash withdrawal |

| Limit size | up to 500,000 rubles |

| Interest rate | from 10% per annum |

| Purchase bonuses | cashback up to 10% in the category "Home-repair", "Family", "Autocard" or "Entertainment", or 2% for all purchases ("All inclusive") at the choice of the holder |

| Issue cost | is free |

| Maintenance cost | is free |

| Registration method | at a bank branch with an online application |

| Terms of registration | 2-3 days |

- Cash withdrawal without commission;

- Large cashback with large limits;

- Free service.

- Large range of bets.

2nd place: "Opening" - "Credit"

This program offers a variety of services to private and corporate clients, both directly and through online projects aimed at working (such as Rocketbank and Tochka). "Credit card" from "Opening" offers an interest-free period of 120 days. A limit of up to 100,000 rubles can be obtained without a certificate of income.

| Grace period | up to 120 days, for non-cash payment |

| Limit size | up to 1,000,000 rubles |

| Interest rate | from 13.9% per annum |

| Purchase bonuses | No |

| Issue cost | is free |

| Maintenance cost | free of charge with the amount of spending from 5,000 rubles per month, otherwise - 100 rubles per month |

| Registration method | Online with delivery to your hands or to a bank branch |

| Terms of registration | 1 – 3 days |

- Delivery in major cities of Russia;

- Can be issued without proof of income;

- Free service with active use.

- There are no bonuses for purchases.

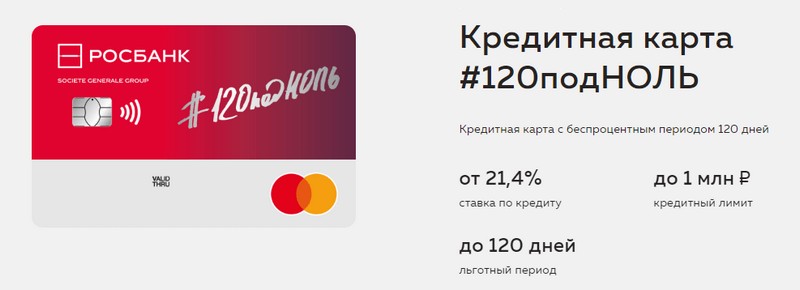

1st place: "Rosbank" - "120 to zero"

The purpose of this program is to give the client a convenient and understandable way to receive any banking services. The credit card of this bank offers a long grace period and a large credit limit. She has no other advantages.

| Grace period | up to 120 days, for non-cash payment |

| Limit size | up to 1,000,000 rubles |

| Interest rate | from 21.4% per annum |

| Purchase bonuses | No |

| Issue cost | is free |

| Maintenance cost | free of charge with the amount of spending from 15,000 rubles per month, otherwise - 99 rubles per month |

| Registration method | at a bank branch with an online application |

| Terms of registration | 3-5 days |

- Large credit limit available;

- Inexpensive service per month;

- A small limit can be obtained from a passport.

- There are no bonuses for purchases.

Up to 111 days grace period

3rd place: MTS Bank — MTS Cashback

The bank offers its customers all types of banking services, including credit cards. This credit card is remarkable not only for a long grace period, but also for a bonus program that will be beneficial to MTS subscribers.

| Grace period | up to 111 days, for non-cash payment |

| Limit size | up to 1,000,000 rubles |

| Interest rate | from 11.9% per annum |

| Purchase bonuses | MTS Cashback points - 5% in the categories "Cafes, restaurants, food delivery", "Clothes" and "Goods for children", 1% for other purchases, up to 25% from partners, can be spent on communication services or goods in MTS stores |

| Issue cost | is free |

| Maintenance cost | free of charge when spending from 8,000 rubles per month, otherwise - 99 rubles per month |

| Registration method | at a bank branch or MTS store with an online application |

| Terms of registration | 3-5 days |

- Fast registration without income certificate;

- Bonus program for MTS subscribers;

- Simple terms of free service.

- Not suitable for customers of other telecom operators.

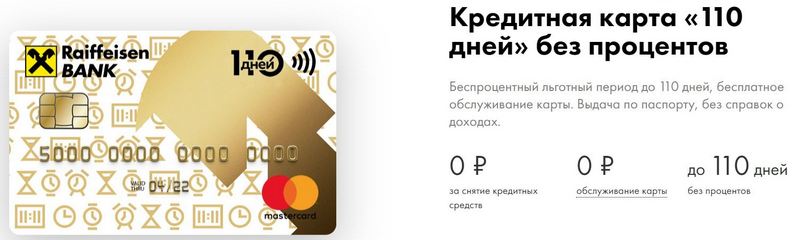

2nd place: Raiffeisenbank — 110 days

FKU has one of the highest reliability ratings in the Russian Federation even today.110 Days is issued quickly and has a long grace period. With frequent spending, its maintenance will be free.

| Grace period | up to 110 days, for non-cash payment |

| Limit size | up to 600,000 rubles |

| Interest rate | from 19% per annum |

| Purchase bonuses | discounts up to 30% at bank partners |

| Issue cost | is free |

| Maintenance cost | is free |

| Registration method | at a bank branch with an online application |

| Terms of registration | instantly |

- Release on the same day;

- You can get a free additional credit card;

- Completely free service.

- High interest rates.

1st place: VTB — Map of Opportunities

This program is considered the most stable. In addition to a long grace period, the card offers a small cashback in points for all purchases. You can also withdraw cash from it without commission at VTB ATMs.

| Grace period | up to 110 days, for non-cash payment |

| Limit size | up to 1,000,000 rubles |

| Interest rate | from 14.9% per annum |

| Purchase bonuses | up to 20% |

| Issue cost | is free |

| Maintenance cost | free of charge if you refuse the bonus program, otherwise 590 rubles per year |

| Registration method | at a bank branch with an online application |

| Terms of registration | 2 – 3 days |

- Free cash withdrawal at VTB ATMs;

- Up to five additional cards in a pack;

- Lower rates for frequent spending.

- Only when issuing a card at the office, cashback is connected;

- Proof of income required.

Conclusion

Today, credit cards with a grace period have become very widespread and are found in almost every Russian bank. This is due to the possibility of avoiding overpayments for some time when using borrowed funds.During the so-called grace period, the owner of the credit card uses the bank's money absolutely free of charge and does not pay interest if he successfully repays the debt on time.

new entries

Categories

Useful

Popular Articles

-

Top ranking of the best and cheapest scooters up to 50cc in 2022

Views: 131651 -

Rating of the best soundproofing materials for an apartment in 2022

Views: 127690 -

Rating of cheap analogues of expensive medicines for flu and colds for 2022

Views: 124518 -

The best men's sneakers in 2022

Views: 124033 -

The Best Complex Vitamins in 2022

Views: 121939 -

Top ranking of the best smartwatches 2022 - price-quality ratio

Views: 114979 -

The best paint for gray hair - top rating 2022

Views: 113395 -

Ranking of the best wood paints for interior work in 2022

Views: 110318 -

Rating of the best spinning reels in 2022

Views: 105328 -

Ranking of the best sex dolls for men for 2022

Views: 104366 -

Ranking of the best action cameras from China in 2022

Views: 102215 -

The most effective calcium preparations for adults and children in 2022

Views: 102011