Ranking of the best books for children about finance for 2025

The world has changed. Most of human activity is controlled by the market. It induces and demands, provides an opportunity for development, destroys. Financial literacy is moving into the section of necessary disciplines not only for adults, but also for children. Market relations either directly or indirectly penetrate into all spheres of services in the economy. A modern child is much earlier faced with situations in which monetary transactions are involved. Many parents consider it necessary to develop their child in advance in the field of financial relationships..

Content [Hide]

- 1 Features of Russian and Western financial literacy

- 2 How to choose

- 3 The best books for kids about finance

- 3.1 Literature for the junior category

- 3.1.1 "Children and money"Authors: Timur Mazaev, Elizaveta Filonenko

- 3.1.2 "Noddy's Adventures in Toy City" by Enid Blyton

- 3.1.3 "Magic ATM", Tatyana Popova, Bulavina Anastasia

- 3.1.4 "Where does the money come from" Author: Elena Uleva

- 3.1.5 "A Dog Called Mani" by Bodo Schaefer.

- 3.1.6 Kindernomics. What is money and how to deal with it ”Author: Artemyeva N.N.

- 3.1.7 “Mathematics and money. We buy. We sell. We change "Author: Tatiana Voronina

- 3.1.8 "How to spend money wisely"

- 3.1.9 "Financial Literacy"

- 3.2 Best publications for the average teenage group

- 3.3 Special Literature Section

- 3.1 Literature for the junior category

- 4 Conclusion

Features of Russian and Western financial literacy

The principles of Western civilization are based on careful attention to money. The well-known book "How to teach a child to handle money", written by Joline Godfrey, teaches to tightly control the pocket funds of children. Current expenses, the state of personal capital, all expenses must be scrupulously calculated, otherwise there will be no new income. The worst thing that can happen is the formation of debt.

Russian upbringing is inferior. The desire to spend everything and not deny yourself anything, experts say, copies the behavior of adults. Competent handling of money is not formed in one generation. Learning to limit consumption in the presence of full counters is not easy for our compatriots.

D.Godfrey talks about the importance of family budget meetings, discussing the success stories of prominent businessmen. The possibility of creating a "Club of future millionaires" for their children and their peers is being considered.

The Russian approach barely falls short of controlling pocket money and financial educational program. It is all the more important to raise a new generation in the best traditions of the proper use of money.

How to choose

- Decor

Young children and preschool children enjoy spending time reading illustrated books with many tasks in a playful way.

- Editorial

The co-authorship of a financier with a psychologist guarantees the competent presentation of materials, taking into account the peculiarities of children's perception.

- Binding

For home reading and joint study, it is better to purchase hardcover editions. Often the opportunity for discussion and collective reading appears on vacation or on holiday trips. Pocket versions and paperback format are more suitable in this case.

- For home library

Increasingly, home interiors are missing bookcases and shelves. Private libraries are becoming a thing of the past, replaced by the ubiquitous smartphones. For parents who want to instill in their descendants not only financial literacy, but also raise an educated person, experts advise having a home library.

A book with bookmarks on the shelf will help you easily find a quote, a well-formed thought. Only relying on the wisdom of the classics in all areas, you can count on success.

Where could I buy

In addition to well-known online stores where you can order the necessary thing via the Internet, many publishers have their own websites, and prices are much lower.Today you can get the right book with delivery in a short time. The variety of forms of payment expands the boundaries of consumption.

Category of children

Different development determines the level of preparation. You can start with the basics and work your way up to more advanced concepts. Preschool age and primary classes can be distinguished into a separate starting category of children. Children of middle and adolescence can be conventionally classified as children with basic financial knowledge.

The best books for kids about finance

Literature for the junior category

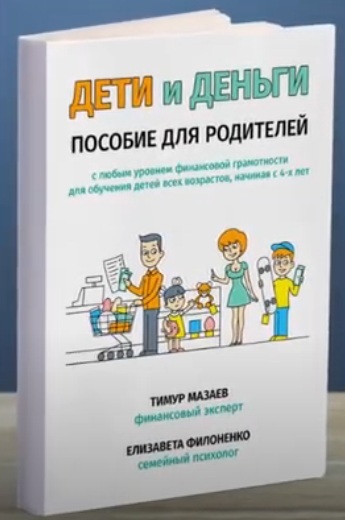

"Children and money"Authors: Timur Mazaev, Elizaveta Filonenko

votes 0

The book is presented as a guide for parents and is designed for any level of financial literacy.

- recommended from 4 years old;

- more than 30 exercises;

- there are tasks to complete;

- concepts of investments and savings;

- analysis of false and true statements about the handling of money;

- accessible presentation;

- the authors are represented by a specialist in family psychology and an expert financier.

- without colorful design.

"Noddy's Adventures in Toy City" by Enid Blyton

votes 0

For little adventure lovers, the writer has prepared extraordinary stories in a magical land.

- acquaintance with the adult world;

- money is involved throughout the presentation, emphasizing its role;

- fascinating stories;

- colorful edition;

- there is a cartoon of the same name;

- can be introduced from the age of 3;

- lots of positive reviews.

- not found.

"Magic ATM", Tatyana Popova, Bulavina Anastasia

votes 0

The adventure genre is always in high demand by the audience.

The main characters are twins. Brother and sister receive a magic ATM as a gift from their aunt, thanks to an unusual device, the children are transferred to the Fairy Island, where they begin to arrange personal economic activities.

- problems available;

- fascinating plot;

- with recommendations for parents;

- the development of a child's conscious attitude to money;

- from the age of five;

- game form;

- availability of historical information.

- parents are advised to correct individual examples so as not to reveal secrets prematurely, for example, the origin of New Year's gifts.

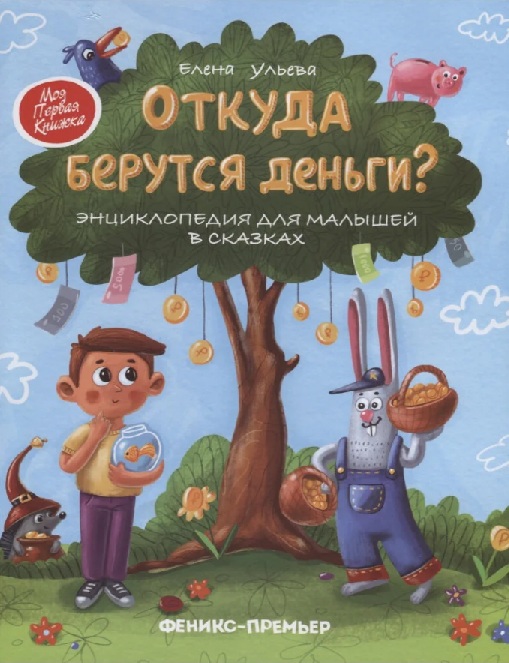

"Where does the money come from" Author: Elena Uleva

votes 0

A fascinating edition is an encyclopedia for kids in fairy tales.

- belongs to the category "My first book";

- explanation of basic principles;

- cash flow;

- through the protagonist Hare, knowledge of financial management is given;

- a history of enterprise in selling carrots and opening a shop;

- gradual development of small business;

- presented in an entertaining way;

- the concept of potential bankruptcy and loans;

- availability of examples;

- exercises to consolidate materials;

- for ages 5+;

- from the famous publishing house Phoenix Premier.

- not found.

"A Dog Called Mani" by Bodo Schaefer.

votes 0

The publication has the status of the most read book about money and teaches the child how to handle finances.

- high popularity rating;

- a fascinating story about a girl who does not know how to handle money;

- set out in the adventure genre;

- with bright design;

- develops practical skills;

- recommended to a wide range of readers;

- the principle of compiling an album of desires;

- keeping a diary of success;

- high information content;

- like children;

- good design;

- for children 6-7 years old.

- not all examples resonate with modern market relations.

Kindernomics. What is money and how to deal with it ”Author: Artemyeva N.N.

votes 0

The plot is based on the desire of a little hero to buy a cell phone. He is waiting for non-standard situations, independent decisions and difficult choices. Dangers lurk at every turn, new knowledge, friends sometimes find themselves on the opposite side of the scale with the pursuit of wealth.

- familiarity with the essence of budgetary funds;

- acquisition of capital, its preservation;

- traps for beginners in the world of finance;

- 70 interactive situations to be resolved together with readers;

- for each correct solution there is a hint in a poetic form;

- mastering the rules takes place in the format of the game;

- made by offset printing.

- no.

“Mathematics and money. We buy. We sell. We change "Author: Tatiana Voronina

votes 0

The book is recommended for children from the age of seven, when the first skills of arithmetic have already been obtained. The publication allows you to instill competent habits and warn against potential dangers.

- subtraction of objects according to specific features;

- division, addition at face value;

- tasks on coins for beginner bookkeepers;

- shop game;

- set comparison;

- work on tables;

- accounting;

- competent presentation;

- accessible mathematics;

- many positive reviews.

- missing.

"How to spend money wisely"

votes 0

The book by Jerry Bailey and Felicia Lo is part of the Knowledge Libraries section. Suitable for children 7-8-9 years old.

- recommended for elementary school age;

- introduction to the law of pricing;

- concept of customs operations;

- the term and essence of the loan;

- psychological aspect of money spending;

- secrets of marketing traps;

- algorithm for competent planning and implementation of expenses;

- simplicity of presentation;

- colorful design;

- visual highlighting of the main laws for improved perception.

- the topic of receiving money as a realization of motivation is not considered.

"Financial Literacy"

votes 0

The book belongs to the series "Your Asset +", is a textbook of reasonable financial behavior. The author Sergey Fedin recommends material for students of the second and third grades.

- accessibility of presentation;

- confidential conversation format;

- captivating story;

- for the skills of competent disposal of cash;

- familiarization information about fraudulent tricks;

- a worthy copy for the home library;

- there is an electronic version.

- designed for a long period of development.

Best publications for the average teenage group

"New amazing adventures in the country" Economy ", Igor Lipsits

votes 0

Young readers are waiting for a journey to the mysterious country of "Economics", where many secrets will be revealed.

- unique illustration by Irina Dedusheva;

- concepts of trade, inflation;

- the theme of the division of society into the poor and the rich;

- advantages and meaning of competition;

- the principle of formation of exchange rates;

- wages under the term equivalent of labor activity;

- the essence of a market economy;

- reliable binding and gloss of the edition;

- fascinating plot development;

- many topics are recommended for family discussion.

- the price is above the average cost in the category of adolescence.

“Treat money like an adult”, Gridin A.V.

votes 0

Book from the series "Coolest of all!" communicates with the reader through fairy-tale characters - mobile phones. Parents appreciate the publication, which is a guide to the future success of children.

- unique approach;

- how to properly manage your money;

- ways of setting goals, their achievement;

- explanation of economic terms;

- a guide to saving the family budget;

- for ages 9 to 14;

- joint reading of adults and children is recommended;

- with practical application;

- elaboration of advice with the help of parents.

- in soft cover.

"Financial Literacy" Author: Natalya Smirnova

votes 0

The publication implies the presence of basic financial basics and expands the conceptual reserve, the skills of financial transactions.

- familiarity with income categories;

- available tools for handling money;

- concepts of benefit and priority of use;

- thematic submission;

- with exciting tasks.

- the official age category is underestimated.

“Your first million. How to Earn It and Not Lose It By: James McKenna, Janine Gleista, Matt Fontaine

votes 0

The authors are the founders of the BizKid$ project and teach the younger generation to confidently build financial relationships.

- information about competent accumulation, investment;

- algorithm for compiling a profitable resume;

- personal enrichment strategy;

- the basics of starting your own business;

- income distribution;

- reasonable investment;

- mistakes and the threat of bankruptcy;

- decent printing performance;

- acceptable price.

- some of the information is focused on the Western mentality.

Special Literature Section

"Financial literacy" Authors: Alexey Goryaev, Valeria Chumachenko

votes 0

The creators of educational literature and working materials within the framework of the school curriculum offer a separate edition for a wide audience.

- literacy of personal finance;

- principles of the banking system;

- specifics of the insurance business;

- features of work of investment funds;

- navigation through financial institutions;

- self-tutor on the development of entrepreneurial abilities;

- first earning opportunities.

- individual moments of operating complex financial terminology.

Rich Dad Poor Dad for Teens by Robert Kiyosaki

votes 0

The book has held a high popularity rating for more than one year. The updated version is presented as a collection of financial secrets that are not taught in school. How to manage your life from the position of a winner, making a choice in favor of the desired wealth, and not wallow in harmful beliefs, the well-known author will answer.

- forms of money movement, their growth;

- special language of the financier;

- how to make funds work for the owner;

- changing the psychology of eternal slavery for the sake of prosperity;

- recommended for adults.

- missing.

| The best books for kids about finance | ||||

|---|---|---|---|---|

| 1. | Younger group | |||

| Name | publishing house | Pages / binding. | Average cost, rubles | |

| Children and money | - | 120 | 200 | |

| Magic ATM | MYTH childhood | 104/hard | 700 | |

| Where does the money come from | Phoenix | 32 | 200 | |

| A dog named Mani | potpourri | 192/solid. | 500 | |

| Kindernomics. What is money and how to deal with it | - | solid | 800 | |

| How to spend money wisely | Mnemosyne | 48/hard | 350÷600 | |

| Mathematics and money. We buy. We sell. We change. | Phoenix | 32/soft | 200 | |

| 2. | Best publications for the average teenage group | |||

| New amazing adventures in the country "Economy" | Vita Press | hard. | 900 | |

| Handle money like an adult | Phoenix | soft/94 | 250 | |

| financial literacy | Finansist | - | 500 | |

| your first million | Mann, Ivanov and Ferber | 144/soft | 750 | |

| 3. | Special Literature Section | |||

| financial literacy | United press | soft/121 | 500 | |

| Rich Dad Poor Dad Teen | potpourri | 128/soft | 500 |

Conclusion

The market and financial relations persistently break into personal life. Increasingly, parents begin to introduce the child to the rules of monetary behavior at an early age. The discussion of the family budget, the solution of urgent material issues takes place with the participation of small family members. This approach teaches the child to be responsible, relieves demanding whims, develops joint motivation. Each family individually approaches the "age readiness" of the baby. Thematic literature is a good helper. Competent presentation and participation of psychologists in the editorial board, the game form and the adventure genre of publications facilitate the selection task. It remains only to decide on the authors, to listen to the recommendations.

new entries

Categories

Useful

Popular Articles

-

Top ranking of the best and cheapest scooters up to 50cc in 2025

Views: 131649 -

Rating of the best soundproofing materials for an apartment in 2025

Views: 127687 -

Rating of cheap analogues of expensive medicines for flu and colds for 2025

Views: 124516 -

The best men's sneakers in 2025

Views: 124030 -

The Best Complex Vitamins in 2025

Views: 121937 -

Top ranking of the best smartwatches 2025 - price-quality ratio

Views: 114978 -

The best paint for gray hair - top rating 2025

Views: 113393 -

Ranking of the best wood paints for interior work in 2025

Views: 110317 -

Rating of the best spinning reels in 2025

Views: 105326 -

Ranking of the best sex dolls for men for 2025

Views: 104362 -

Ranking of the best action cameras from China in 2025

Views: 102214 -

The most effective calcium preparations for adults and children in 2025

Views: 102010