Best Life Insurance Companies for 2022

An impressive amount for the purchase of an apartment, the down payment of a mortgage, a wedding or training at a prestigious university can be saved by insuring your life. The best life insurance companies for 2022 will help you choose the right option for additional income, pension supplements.

Content

What are

Insurance organizations have the right to operate if they have a license (special permission to provide services) issued by the insurance supervisory authority.

There are several criteria for classifying organizations:

- The number of branches, points - regional (a certain area), federal (throughout the country).

- Organizational form - OJSC, LLC, CJSC.

- Specialization - universal (large selection of offers), specialized (only one or two services).

- Origin - foreign, domestic.

- Significance for the development of the economy - backbone.

The number of operating companies is 185 (data of the Central Bank of the Russian Federation, 2019).

Types of life insurance

Life insurance (abbreviated as SL) - material assistance to a certain person, relatives in case of unforeseen circumstances.

There are four main types:

- risky;

- cumulative;

- investment;

- voluntary.

risky

Allocate "pure", mixed type. "Clean" - two types of payment (one, several), only one insured event (death). Mixed - other risks are added, used for active travel, high risk in the workplace, the possibility of an accident, a mortgage loan, imprisonment.

An insured event occurs if injuries are received, hospitalization, surgery, disability, death.

There are options: individual, family, group (corporate). Validity - from 1 day to several years, until the end of life. Payment - one, several equal installments.

Cumulative

Two options are combined - insurance, accumulation. Time - from 5 years to the end of life. Less than 5 years - low yield.

Options "survival", "survival to a certain event" (a certain period) - receiving savings without additional tax fees.

Death before the end of the term - payment of the entire amount to relatives.

Investment

Funds are divided into two parts - guarantee (stable in an unfavorable situation on the stock markets), investment (the organization invests money, receives additional income).

There are two investment strategies: conservative (low risks, less profit), aggressive (high profit and risk).

Voluntary

Voluntary pension is applied at retirement. You can choose a specific period (2-5 years), a permanent addition.

Voluntary medical - additional services (round-the-clock communication, selection of doctors, emergency hospitalization). For older people, risk groups - a multiplying factor (the cost of the policy increases).

Corporate clients benefit from: tax benefits for the employer, additional discounts for employees.

How to choose

When choosing, you should find out the information:

- Having a license.

- Work experience.

- Customer reviews.

- Expert ratings.

- Basic, additional conditions.

- Clear website, online consultations.

- Registration of documents online.

- Fast communication at any time.

Before concluding an agreement, you should pay attention to the validity period, the amount and frequency of contributions, exceptions and denials of payment, and the conditions for early closure.

Best Life Insurance Companies for 2022

The review of companies is based on customer reviews, expert assessments. There are two categories according to the start time of work: before 2000, after 2000.

Russian insurance companies that started their activities before 2000

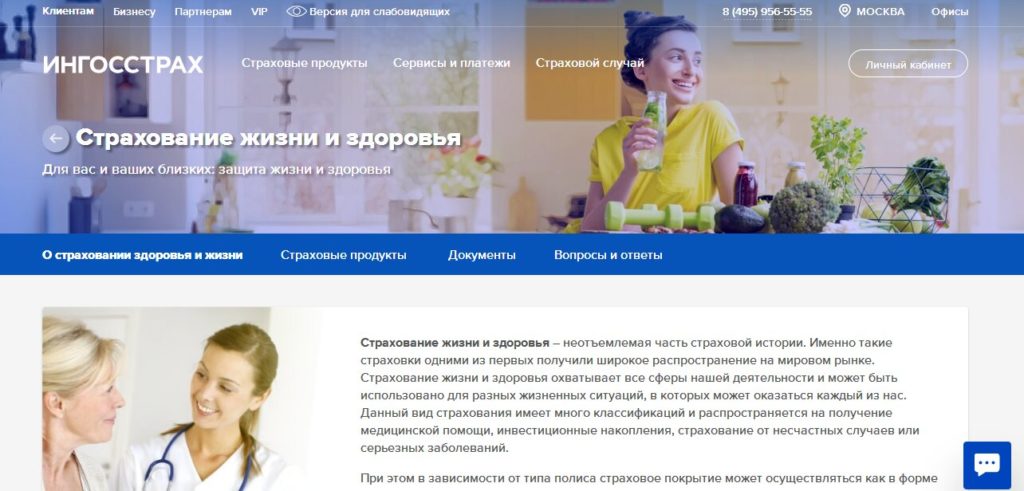

5th place Ingosstrakh

Type - SPAO (insurance public joint stock company).

Founded in Moscow (1947). Owns capital (billion rubles): authorized - 27.5, own - 68.6.

It is the receiver of the GU of foreign insurance of the USSR.

Offers a wide range of services. Additional insurance features: cargo, shipping, dangerous objects.

Website design - white background, blue accents.

The central place is the automatic change of current offers on a blue background:

- e-OSAGO policy.

- CASCO.

- Travel abroad.

- Digital card "Ingosstrakh Bonus".

- Mobile app.

- "Avantage apartment".

- Avantage Invest.

- Flat.

The top two horizontal lines: clients, business, partners, VIP. There is a transition to a version for visually impaired people. The right corner is the phone number, the company's offices.

Second line: fear. products, services and payments, fear. case, the entrance to the personal account.

All options are supplemented with a special calculator.

Additional information is displayed: promotions and special offers, Ingosstrakh bonus.

The lower part is partners, news. Additional communication through social networks (facebook, vkontakte, instagram, classmates), YouTube video hosting.

There is a mobile application, the ability to get information on the site online.

- extensive work experience;

- many services;

- bonuses, Ingosstrakh card;

- convenient choice, calculator;

- information on social networks;

- mobile app.

- not identified.

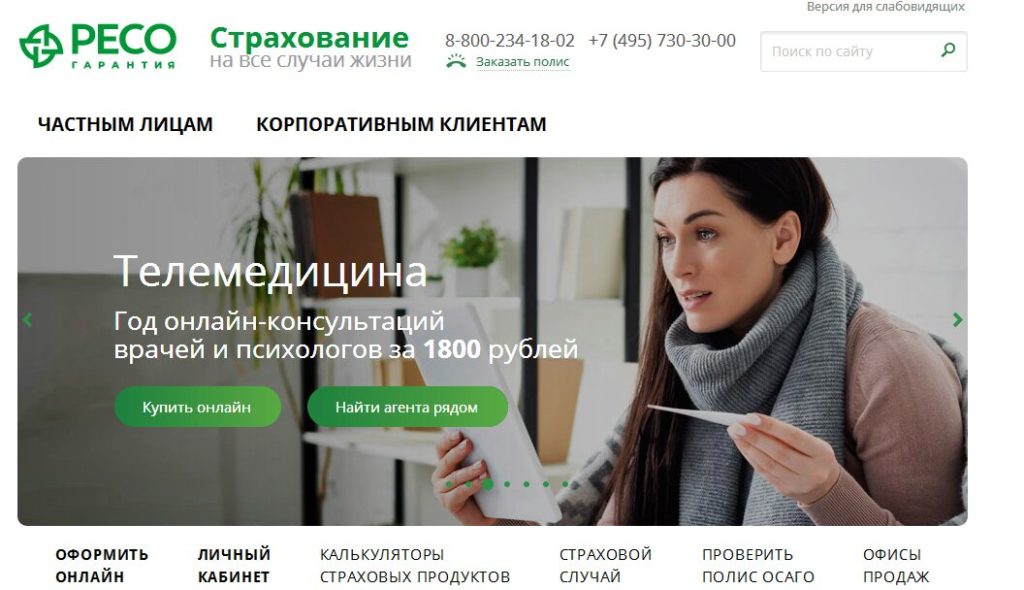

4th place RESO-Garantia

The full name is CAO (insurance joint-stock company). Opened in 1991. Changed three names. It has 1,200 branches, points of sale, more than 34,000 insurance agents.

The site is designed with a white background, green highlights, black font.

Upper part: phone numbers, search bar, transition to the version for visually impaired clients.

There are two groups - private and corporate persons.

There are seven promotional presentations:

- OSAGO online.

- It's time for vacation!

- Telemedicine.

- Anti-crisis proposal.

- CASCO policy.

- From accidents.

- DMS.

All options are accompanied by a cost calculator, search for an agent nearby.

Middle of the page - six categories (register online, personal account, calculators, page case, policy check, offices).

There is a search for agents by location, the latest company information, an offer to become an insurance agent (new course of study).

A mobile application "RESO Mobile" has been developed.

Additional communication through social networks (facebook, instagram, vkontakte).

- many branches;

- different types of policies;

- handy calculators;

- clear site navigation;

- mobile app;

- long term of work;

- high ratings.

- There is no online consultant on the site.

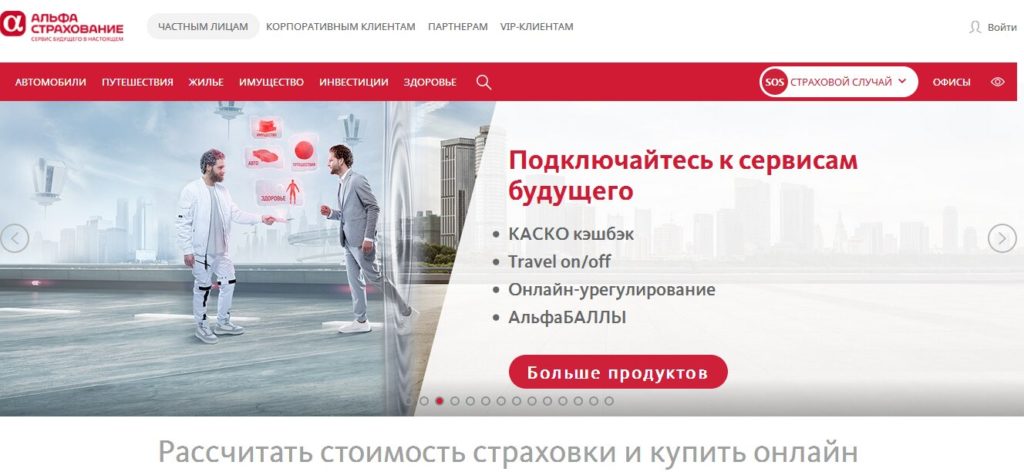

3rd place Alfa insurance

Type - insurance group (JSC Alfastrakhovanie, LLC Life, LLC OMS, LLC Medicine). Time of creation - 1992. Wide network - 380 regional departments.

Modern site design - basic white background, gray font, red accents.

Upper horizontal line: individuals, corporate clients, partners, VIP clients.

The choice of services is highlighted in red:

- cars (OSAGO, CASCO, calculators, extensions);

- travel (foreign, domestic, Schengen visa, passengers, Alpha Aviation, green card);

- housing (apartment, cottage, mortgage, property rights, municipal, extension);

- property (all inclusive, purchase protection, alphaport);

- investments (accumulation, investment, preservation, protection);

- health (VHI, from viruses, accident, alpha drive, alpha mite, anti-onco).

Additional services - for corporate clients (benefits, from accidents), coronavirus infection (complications, diseases).

There are 14 promotional designs of popular offers.

The middle of the page is the possibility of calculating, selecting, buying online a suitable option.

A simple travel insurance calculator (choice of country, travel dates).

An additional function is policy management (renew, activate, buy, page case).

Benefits highlighted:

- Over 100 offers.

- 270 representations.

- High level of reliability "ruAAA".

- 29 years of work.

- Online clearance.

There are latest news, history, basic services.

The mobile application can be downloaded from the App Store, Google Play. There is an English version of the site, an option for the visually impaired.

The link number is at the bottom of the page.

- long term of work;

- many options;

- convenient site menu;

- calculators;

- online registration;

- mobile applications;

- version for the visually impaired.

- no emergency numbers assigned.

2nd place VTB Insurance

Type of organization - LLC (limited liability company), founded in 2000. Refers to the system-forming type.

Changed three names, modern "VTB insurance" - since 2008. Positions: 7, 9 - collection of insurance premiums, 9 - media activity (2016).

It has 250 points, 39 branches.

The web page is designed on a white background, blue and black font is used.

Top line: contact form for various purposes, transition to the English version.

There is a choice of place of residence, contact number in the city, addresses of branches.

The left side is the opportunity to ask a question (online, offline via email, phone).

Online services provided:

- health (children's doctor, excellent protection, tick-borne encephalitis, compulsory health insurance);

- auto (casco);

- travels;

- property (advantages, mortgage, military personnel);

- life (investment, accumulation).

Center position - automatic program selection in four categories:

- Private or corporate clients.

- What do you insure?

- Select from the list.

- Pick up.

Middle - service buttons (insured event, activate policy, next payment).

Bottom part added top news, three numbers (short, free, Moscow). Communication through social networks - instagram, vkontakte, classmates, facebook.

An additional function is an insurance alarm clock (reminder for 1, 2 weeks, 3 days).

- universality;

- years of experience;

- convenient selection according to criteria;

- separate conditions for military personnel;

- many branches, outlets;

- communication through the website, numbers, social networks;

- There is an English version of the site.

- not identified.

1st place Sogaz

Joint stock company (JSC "Sogaz") - insurance company for the gas industry (1993). It is a subsidiary of Gazprom.

Has capital (billion rubles): authorized - 30.1, own - 110.

Ranked 1st in terms of insurance premiums (2019).

The main page of the site has an upper horizontal panel: menu, private clients, insured event, policy activation, personal account. There is a round-the-clock phone number, communication with the company.

There are 9 advertisements for different policy options, buttons for detailed information, online purchases.

The lower part of the page contains news, ratings, a register of agents and brokers.

Partners - 21 companies have been selected.

The menu offers services:

- auto insurance (OSAGO, auto hull, AUTO-NS);

- real estate (mortgage, simple and personal solutions for apartments, houses);

- travel (abroad, in Russia);

- life and health (Dr. Like, person, cancer care, ask a doctor, passengers);

- life and savings (piggy bank, confident start, multi-protection, confidence index).

The “persona” service has four varieties: economy, anti-tick, special, universal.

There is a mobile application that can be downloaded through Google Play, App Store.

- long term of work;

- high rating, stable outlook;

- understandable site;

- convenient design;

- round-the-clock phone number;

- mobile app.

- there is no online connection on the site with a consultant.

Russian companies that started operations after 2000

2nd place Renaissance Life

The full name is SK Renaissance Life LLC. System-forming company, operating since 2004.

The site is designed on a light background, purple and yellow inserts.

Upper horizontal line: clients, agents, contacts, insured event, receive savings, payment. There is an entrance to your personal account, search for information on the site.

Feature - the location of the menu button in the right corner. Categories: personal building programs, clients, agents, partners, about the company, corporate insurance.

Eight relevant offers are highlighted, which automatically replace each other on the screen:

- Center for Quality Control.

- Services for clients.

- Any question without leaving home.

- Zen subscription - financial life hacks.

- Future for yourself and loved ones.

- Treatment in foreign clinics.

- Own business - financial consulting.

- Plan for the future.

There are three types: risk, accumulation, investment with detailed characteristics.

Additional communication through the quality control center, consultations - through WhatsApp.

Bottom of the page: reviews, benefits. Advantages of the company: 70 branches, 17 years of experience, 3 mln.regular customers, high rating of experts.

Connecting numbers for Moscow, the Moscow region, and other regions have been allocated.

- work experience;

- wide network;

- convenient site navigation;

- established communication through the website, WhatsApp;

- color settings, visually impaired version.

- not identified.

1st place Sberbank life insurance

A subsidiary of Sberbank, which owns 100% of the shares. Obtaining a license - April 2012.

Type of organization - LLC (limited liability company).

Types of insurance services: life, accident, investment, pensioners.

The main page of the site is light gray, white background, green inserts. Top panel: phones for communication (free of charge, communication with the smart assistant "900"). There is a search, an insured event, an entrance to your personal account. Three screensaver options: “Who will your child be?”, “How to save money?”, “Healthy employees”.

The right corner is a menu with the main categories:

- savings;

- life and health;

- investments;

- credit;

- glossary;

- sberPremier, sberFirst;

- to corporative clients;

- COVID-19;

- signature verification.

There is information about contacts, documentation, news, vacancies, indicators.

The bottom panel is a button for online communication with a consultant.

Life and Health contains packages: "Active age", "Protected borrower", savings with the return of contributions, "Airbag". Additionally, there is a 24-hour Coronavirus hotline.

Ranked #1 since 2014. It is a member of the All-Russian Union of Insurers. According to the rating of the international agency "Expert RA": stable outlook, "ruAAA".

- high rating, stable outlook;

- wide network;

- many options;

- several communication numbers;

- online consultation of a specialist on the site.

- no mobile app.

Conclusion

Insurance will help you get additional income, invest in a profitable project, save up for a good vacation. The best life insurance companies for 2022 will help relatives and children choose the right contract.

new entries

Categories

Useful

Popular Articles

-

Top ranking of the best and cheapest scooters up to 50cc in 2022

Views: 131656 -

Rating of the best soundproofing materials for an apartment in 2022

Views: 127697 -

Rating of cheap analogues of expensive medicines for flu and colds for 2022

Views: 124524 -

The best men's sneakers in 2022

Views: 124041 -

The Best Complex Vitamins in 2022

Views: 121945 -

Top ranking of the best smartwatches 2022 - price-quality ratio

Views: 114983 -

The best paint for gray hair - top rating 2022

Views: 113400 -

Ranking of the best wood paints for interior work in 2022

Views: 110325 -

Rating of the best spinning reels in 2022

Views: 105334 -

Ranking of the best sex dolls for men for 2022

Views: 104372 -

Ranking of the best action cameras from China in 2022

Views: 102221 -

The most effective calcium preparations for adults and children in 2022

Views: 102015